Exceeding 100 Employees Reduces Healthcare Costs

Small Group vs Large Group Insurance High growth companies, especially those in the tech startup world, often race past the large group health insurance milestone without much fanfare. It’s understandable. Until you hit 50 or 100 employees (...

Before a RIF, factor in small vs large group health plan costs

If you’re contemplating a reduction in force (RIF) to cut your operational costs, it’s critical to avoid this all-too-common mistake. Large vs Small Group Health Plan Costs If the RIF will drop you down from large group to small gro...

These Carriers are Waiving COVID-19 Treatment Costs

Health insurance carriers are already covering COVID-19 tests, and many are covering telehealth costs associated with COVID-19 screening. These carriers have recently announced they're waiving coronavirus treatment costs. Aetna Waives Coronavi...

HSA Expansion Option for Employers

If you're wondering how IRS Notice 2019-45 ("HSA Expansion") affects your employer-sponsored High-Deductible Health Plan (HDHP), you're not alone. This was the most asked question in a recent "2020 Employer Benefits Legisl...

The Game Theory Behind Health Plan Renewals

For most U.S. employers, providing employee health care coverage is a cost of doing business, not your core business. And it's the second largest operational expense after wages. Yet HR and finance professionals have little—or no—visi...

Help for a High Health Plan Renewal

It’s health plan renewal season, and some employers are in for a sticker shock. But, before you swallow a double-digit rate hike that will cost you and your employees, it’s critical to find out whether the rate is, indeed, a fair reflecti...

How to Leverage Claims Analytics

At around 250 employees, your company should be getting your medical claims from your broker or carrier. This claims visibility is a good start to understanding your healthcare costs, but this is just the first step. The real key to managing cos...

Debunking Employer Healthcare Costs

Twenty percent of employers, of all sizes, increased their health-related benefits over the last 12 months according to the SHRM 2019 Employee Benefits Survey. And, no surprise here: healthcare benefits and their rising costs remain top of mind. B...

A Fintech Approach to Better Employee Benefits

My background in fintech combined with an awful experience navigating health insurance for a chronically ill loved one is where the Lumity story starts. As a co-founder of Motif Investing, making employee benefits decisions fell on my shoulders. A...

HDHPs have an Ugly Branding Problem

Traditional PPO plans saddle both employers and their employees with high monthly premiums. For this reason, many employers offer High-Deductible Health Plans (HDHPs) with lower premium costs—and then offer Health Savings Accounts (HSAs) to hel...

6 Ways Employers Can Cut Costs, Not Benefits

Today, most employers make health plan and benefits decisions blindly. Employees know how much they're spending on health care, but they have little say in deciding which plans a company will offer them. Yet you share a common goal: lowering...

How to Drive HSA Adoption: Educate Employees

In our previous post about driving Health Savings Account (HSA) adoption, we covered how to mitigate employee risk with your health plan design. In this final post in our series, we’ll focus on employee HSA education. HSA survey respondent...

How to Drive HSA Adoption: Mitigate Employee Risk with Plan Design

Where we last left off in this series, the key takeaway was “money talks”: finding your employer contribution sweet spot incentivizes further employee Health Savings Account (HSA) uptake. But after the right employer contribution is in pl...

[On-Demand Webinar] Ending Renewal Roulette

With employer healthcare costs rising 2-3x faster than wages, blindly hoping for a good “trend” renewal isn’t sustainable. Join us for a 15-min 'skim'-inar to learn how your company can regain control and.

How to Drive HSA Adoption: Seed Early Adopters

We're launching this "How to Drive HSA Adoption" series to share insights derived from Lumity's 2018 State of the HSA Survey. More than 350 professionals in HR and finance responded to our survey, and over 97 professionals...

A seamless transition to better benefits with cost savings

How Lumity helped Gametime transition seamlessly off Zenefits, get better benefits and realize savings at the same time. PAIN POINT 100-person Gametime was rapidly adding headcount and looking to move off their current Zenefits HRIS platform. T...

Save Money By Increasing Company Health Plan Participation

As the saying goes, there's strength in numbers. Getting employees to enroll in your company health plan has never been more important. Many insurers require a large percentage of eligible employees participate in your company-sponsored health pl...

Better Benefits: Brokers and the Rabbit Hole of Fees

Budgeting for benefits. Every year during FP&A, finance professionals gather around spreadsheets trying to read the tea leaves on expected company benefit costs for the coming quarter or year. CFOs need to budget cash reserves (for self fundin...

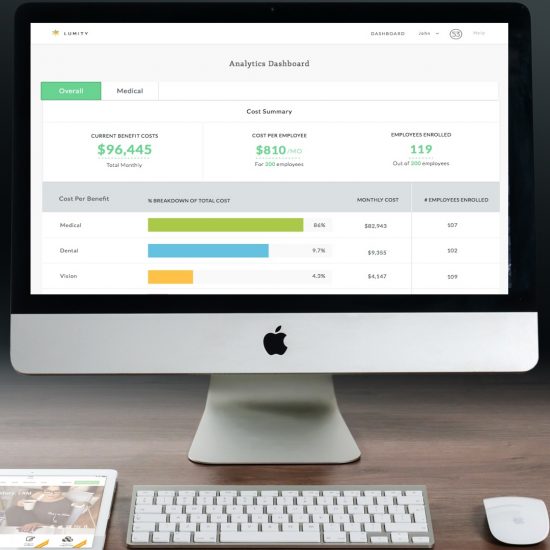

Data-Driven Benefits: New Health Plan Analytics

Today, we're proud to announce the launch of our real-time Health Plan Analytics. We're empowering HR with the insights to assess health plan usage throughout the year, including employer-provided HSAs and FSAs, and enabling...

Spotlight Series: Affordable, Minimum Value Health Plans

When it comes to compliance with the employer mandate of the Affordable Care Act (ACA), you are responsible for ensuring that you not only provide coverage to your full-time employees if you're an applicable large employer, but also that your pla...

Level (partial-self) funding: A data-driven path to self insurance

The Affordable Care Act has caused a fundamental shift in the way employers think about offering healthcare and health plans to employees. Starting in 2016, the onset of the Employer Mandate and the expansion of Community Rating&n...

Democratizing Health Insurance for the 99%

By Tariq Hilaly, Co-Founder and CEO For many Americans the healthcare system is a disaster. The cost continues its steady march upward. Insurance premiums are skyrocketing 3x faster than inflation1 - often for reasons few understand. There’s...

![[On-Demand Webinar] Ending Renewal Roulette](https://lumity.sooperior.com/images/1563441255End-Renewal-Roulette.png)